Consumer Credit Debt

If it’s broke, do not fix it,” appears to mirror the current administrations feedback to the continued abysmal performance of the big Servicers in carrying out programs to keep people in their homes.

I recently talked to an associate at one of the Mega-Servicers that showed me that out of the last 20,000 Home Cost effective Alteration Program (HAMP) bundles sent to house owners that only 400 of those plans caused a finished lending modification. Our company’s analysis of the work-flow processes of the Servicers clearly shows “big service and also modern technology spaces” that clarifies why only an extremely little portion of home owners have in fact gained from financing modifications.

In fact, the Amherst Stocks Group lately launched numbers showing that 80% of all nonperforming private-label home loans have not been customized after twelve month and also as of Sept. 30, 2010, that the Fannie Mae servicers had actually finished only 321,800 modifications including 158,800 restructurings that satisfy Residence Inexpensive Adjustment Program (HAMP) specs out of almost two million note holders believed to be eligible for loan workouts. Fannie has 60,500 debtors in HAMP trials, which represents just 6% of its seriously overdue loans.

This discussion will certainly concentrate on specific areas of the Servicer work-flow processes that add to the “huge service and innovation voids,” in the method which lending work-outs are initiated and refined.

The Acting FHFA Director Edward J. DeMarco disclosed just recently on December 2nd that the, “Servicer’s deficiencies undoubtedly show stress on a system that is operating beyond capacity as well as was never ever created to deal with the volume of nonperforming financings that we are seeing today.” He concludes that, “they additionally stand for a breakdown in corporate interior controls and also the stability of home mortgage servicing and processing.”

Naturally, the recent scrutiny of Servicer repossession practices is additional subjecting Servicer insufficiencies; clearly, the large quantity of delinquent home owners has put extreme stress on Servicers, including their financing exercise initiatives. With the John Burns Property Consulting company approximating that the “darkness supply” of residences is headed in the direction of 4.7 million repossessions, it is noticeable that Servicers must substantially overhaul their work-flow procedures in order to have a dealing with opportunity at developing some head winds against the growing momentum of REO supplies.

‘Right’ Event Get In Touch With Issues

Servicers utilize poor approaches to contact as well as involve the borrower in order to assess whether a work-out can be accomplished. With a lot of customers capitulating because of delinquent home loan, and also unsafe consumer financial obligation such as charge card financial obligation and also personal lines of credit, an expanding number of home owners simply do not trouble to answer their phones to avoid the anxiety of dealing with high pressure collector.

A large bulk of the Servicer’s framework as well as staff is consumed by servicing collection telephone calls, going after customers that are overdue and also barraging families with several telephone call daily that are generated by automated dialers. To be clear, the objective of these phone calls is to accumulate on overdue home loan and charge card financial debt payments, not to supply a positive strategy in aiding the customer recognize his/her options. As Director Demarco has plainly specified, Servicers were never ever prepared to deal with the acceleration of nonperforming financings; however after several years of failure it is now time for the Servicers to welcome some new processes and modern technologies to much better handle, track and also automate the lending life-cycle.

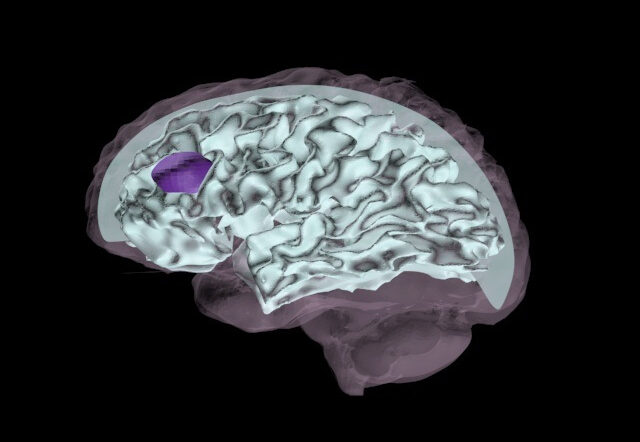

Utilizing a ‘Right Party Contact Design’ that makes use of accredited Field Providers Representatives that make multiple trips to the residence and also speak with neighbors in order to make straight contact with the actual borrower is coming to be a intregal step in work-flow procedure. When spent for by the Servicer, a live monetary interview is conducted and also the homeowner’s current earnings as well as employment info are fed into an Automated Analytics Engine to determine whether a note holder gets a car loan alteration; if so, a HAMP Bundle is generated to be printed and hand delivered to the note holder.

Upon conclusion, the HAMP package is then checked over for precision and also efficiency by the Area Solution Representative (or refining center) after that forwarded straight to the Servicer for final approval. In the present Servicer design so many note holders are merely overlooked as the Servicer possesses no predictable procedure to make certain the note holder outreach, credentials, shipment, handling of records and also approval for a note holder that would generally receive a finished finance modification if the appropriate procedure technologies remained in area.

If it is established that the property owner lacks the adequate revenue to meet the standard HAMP certifications, the consumer has to begin to consider his/her other sensible options. Given either possibility, an aggressive outreach methodology boosts contact prices which subsequently enhance the variety of house owners that will in fact attempt as well as inevitably qualify for a lending alteration. On top of that, the borrower is more likely to react positively to other alternatives, such as a short-sale, after an attempt is made by the Area Services Representative to qualify the consumer for a loan adjustment, even if they do not certify. The factor is that it is the obligation of the Servicer to contact as well as involve the customer which simply is not being done.

Our troubled possession workout program makes use of extensive web present value and falls algorithms that can be personalized to specific Investor and even program-level specifications, permitting very targeted workout programs for each class of troubled possessions for the benefit of Financiers while also offering the note holder immediate comments on the likelihood that a workout can be attained or whether other choices must be pursued such as short-sale to create a dignified departure for the note owner that can not manage to remain in the home. Learn more info on consumer debt in this link, https://cybercrew.uk/blog/debt-statistics-uk/.